Liquid staking on Solana addresses a fundamental capital efficiency problem. Native staking requires locking SOL with validators, meaning stakers cannot trade this SOL or use it in DeFi. Liquid staking protocols solve this by issuing derivative tokens that maintain staking exposure while enabling secondary market activity and DeFi deployment.

The market data shows significant adoption. Solana's liquid staking sector holds over $10.7 billion in TVL, with 13.3% of all staked SOL now liquid (57 million SOL) as of 10/20/2025. Participants are capturing multiple yield streams: base validator rewards (6-7% APY), MEV tips through specialized protocols, and DeFi composability via lending and liquidity provision. Some configurations achieve combined returns exceeding 10%.

What Is Solana Liquid Staking?

Liquid staking converts traditional stake positions into fungible tokens that represent native staking rights while maintaining liquidity. Instead of locking SOL directly with validators, users deposit into stake pools and receive Liquid Staking Tokens (LSTs) like JupSOL, bbSOL, or JitoSOL. These tokens continue accruing staking rewards while remaining tradeable and deployable across DeFi protocols.

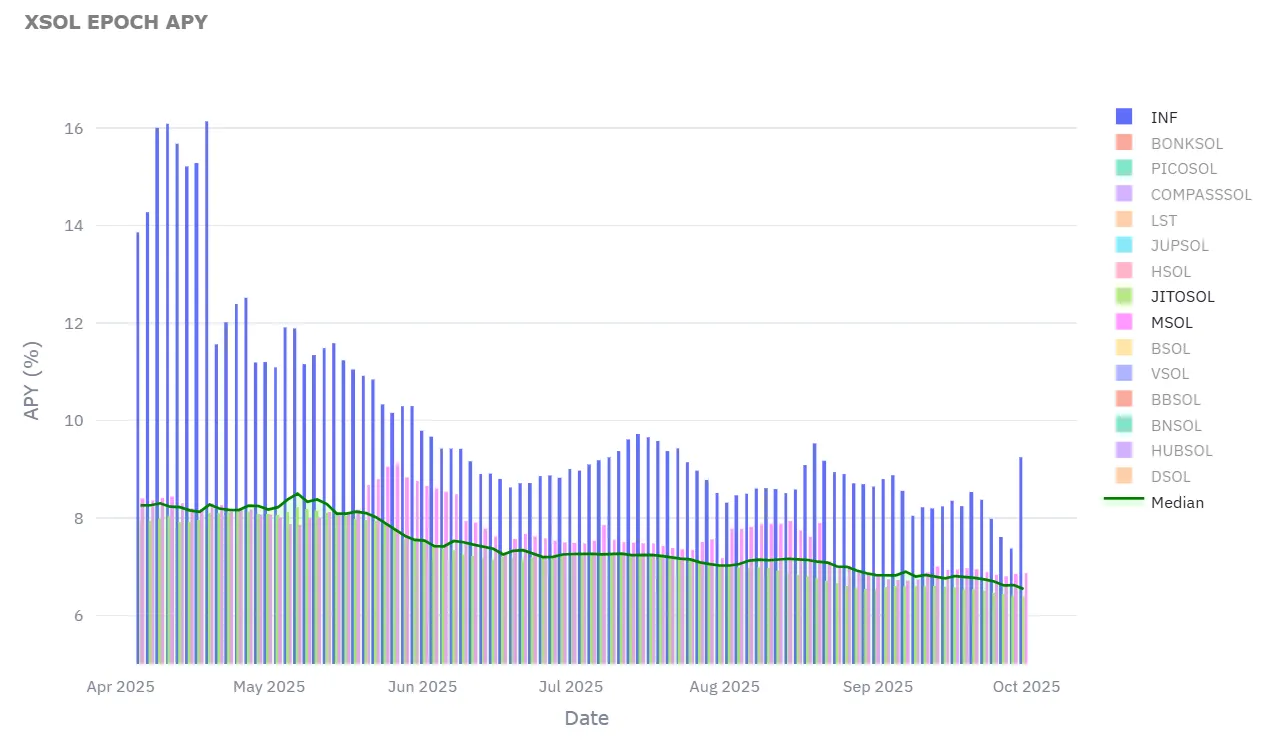

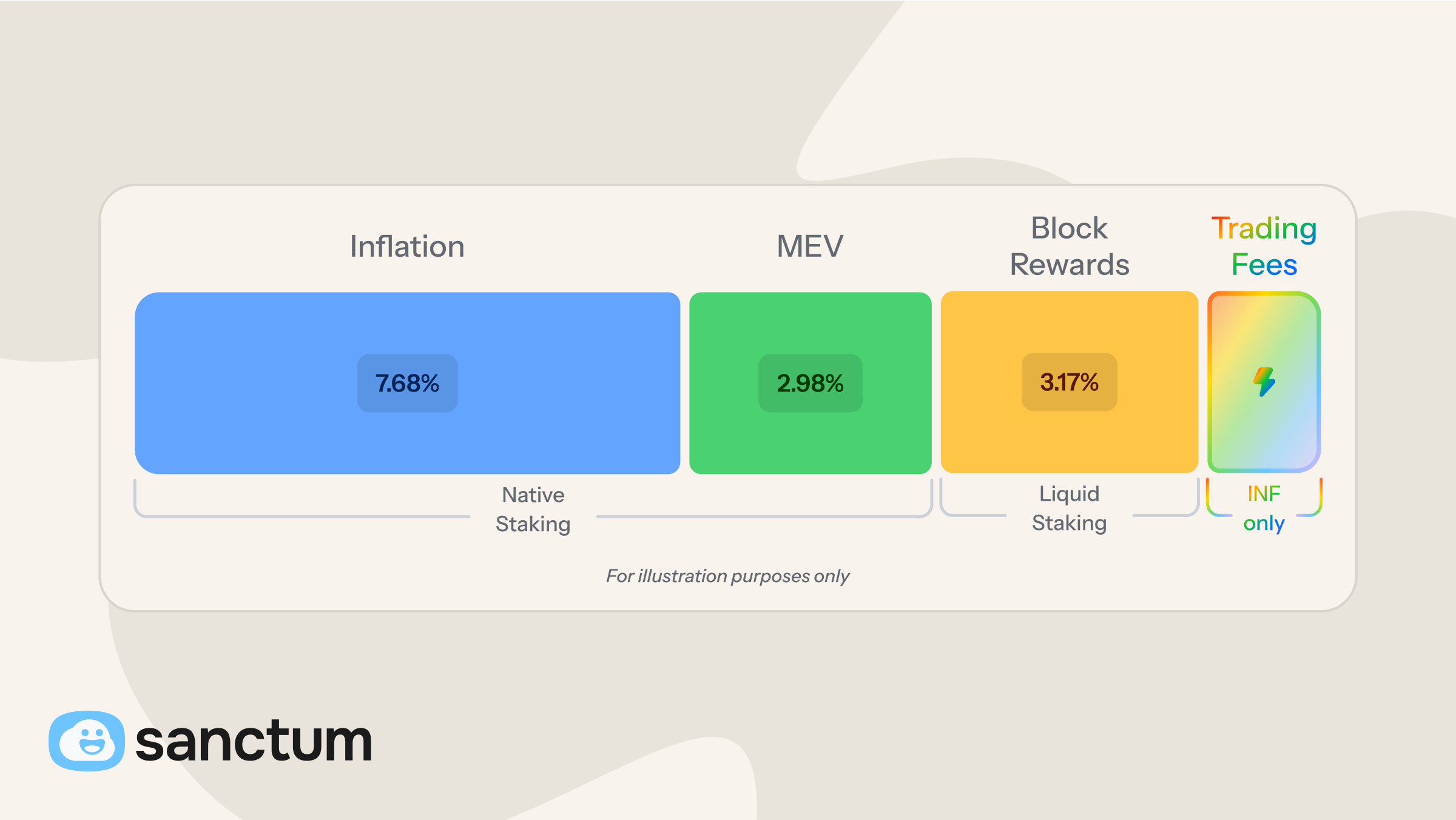

Liquid staking doesn’t capture all available yield though. Liquid staking tokens like JitoSOL only capture yield from inflation, block rewards, and MEV. Sanctum offers a higher yield than JitoSOL by stepping beyond liquid staking with Sanctum Infinity tokens (INF).

INF outperforms traditional LSTs by acting as a liquidity pool for other LSTs. INF holds a basket of LSTs and unstaked SOL. Since it holds the basket of underlying LSTs, INF gets all of the appreciation of those LSTs. INF also offers liquidity via it’s unstaked SOL yielding trading fees for it’s holders. Infinity also generates fees when it facilitates a swap between two LSTs.

As a result of these additional fees that are collected, Infinity has outperformed all LSTs since launch.

This means Infinity isn’t a liquid staking token exactly, rather it’s one step further. You can think of it as a managed portfolio of LSTs with strict boundaries on what the manager (Sanctum) can and cannot do. For stakers, Infinity provides the same benefits as traditional liquid staking tokens and more.

Keytrends shaping Solana liquid staking:

- MEV is now table stakes: Nearly all LSTs include MEV in their rewards. What was once a differentiator is now expected in any token.

- Unified liquidity layers: Sanctum is the only product to aggregate multiple LSTs into shared liquidity. This reduces slippage and improves capital efficiency for the entire ecosystem, rather than fragmenting liquidity across isolated pools. Providing liquidity to LSTs also yields trading fees which allows Infinity to outperform traditional LSTs.

- Institutional adoption of Solana LSTs: Large institutions are increasingly leveraging LSTs on Solana as a source of yield. Institutions also need liquid. LSTs and INF token provide both a more liquid option and higher yield.

- Digital Asset Treasuries are emerging as major LST stakeholders: Publicly traded DATs like DeFi Development Corp (DFDV) are leveraging custom liquid staking infrastructure to power their treasury strategies, turning staked SOL into tradable assets that provide both yield and liquidity for shareholders. This represents one of the fastest-growing segments in liquid staking, as institutional treasuries seek regulated vehicles that combine staking yields with the liquidity and composability of LST tokens.

- DeFi composability unlocks new yield strategies: LSTs are increasingly being integrated into lending protocols and other DeFi primitives, enabling sophisticated strategies like collateral looping. By integrating INF into platforms like Jupiter Lend, users can borrow against their staked positions and compound their yield.

Who Needs Liquid Staking (and When)?

Solo stakers and small holders: Let’s say you’re staking 50 SOL but see a promising lending opportunity on Kamino. With traditional staking, you'd wait 2 to 3 days to unstake, missing the window. With liquid staking, you deposit that 50 SOL, receive 50 SOL worth of LST tokens, and can immediately use those as collateral to borrow stablecoins. Your original SOL keeps earning staking rewards throughout.

DeFi power users: Can increase their yield over basic staking by capturing additional reward streams while still participating in DeFi with a liquid token. Liquid staking lets you earn base validator rewards, captures MEV tips and provide liquidity. All while simultaneously keeping liquidity on your Solana.

Protocols and institutions: You're at the point where you need branded staking solutions for your community, want to run a validator without massive liquidity requirements, or need instant liquidity for large SOL positions. LSTs, through platforms like Sanctum, let exchanges, DAOs, and projects launch staking products that strengthen their ecosystem while earning commission on delegated stake.

Signs you should be using liquid staking:

- You hold SOL but want to earn DeFi yield without unstaking delays

- You're looking for yields above the baseline 6-7% APY from standard staking

- You need instant liquidity without sacrificing staking rewards

- You're managing an institutional treasury, ETF, or Digital Asset Treasury vehicle that needs regulated, liquid exposure to staking yields

How We Chose the Best Solana Liquid Staking Pools

We graded each option on the following set of criteria to pick which staking tokens were the best.

Security and Audits – 35*% Weight*

Smart contract risk is real. We focused on protocols built with transparent, audited code and favored those using Solana’s proven SPL stake pool program. The foundation has been audited multiple times and currently secures billions in total value. Projects with additional third-party audits or formal verifications earned higher marks for security and reliability.

Yield Optimization – 30% Weight

Tokens are rated on how much yield they offer to holders. The higher the APY, the higher the rating. Protocols that capture MEV tips, priority fees, or transaction value offer better yields and perform better. Our scoring favored platforms with sustainable, transparent, and consistently superior net yields rather than short-term incentives.

Liquidity Depth – 20% Weight

LST performance during market volatility depends on exit liquidity. Evaluation included on-chain liquidity depth, integration with major DEXs and lending protocols, and peg stability under stress. Protocols offering high APY but limited liquidity were penalized for exit risk and potential slippage during redemptions.

Validator Strategy – 10% Weight

Validator delegation determines both performance and decentralization. We analyzed delegation concentration, validator set size, and rebalancing algorithms. Single-validator pools carry higher concentration risk, while broad distribution across 100+ validators enhances network resilience. Sophisticated delegation logic earned higher marks.

Innovation and Differentiation – 5*% Weight*

Liquid staking is rapidly evolving. We rewarded protocols that advance the ecosystem through novel liquidity routing, restaking infrastructure, or incentive design, rather than incremental feature additions. Architectural originality and composability with Solana’s broader DeFi stack were key differentiators.

Overall Evaluation Philosophy

Protocol architecture shapes outcomes. Some platforms operate as full-stack ecosystems, integrating staking, liquidity, and DeFi primitives. Others excel as specialized solutions for yield maximization, MEV capture, or instant redemption. The ideal choice depends on whether user priorities emphasize breadth, depth, or specialization.

The 7 Best Solana Liquid Staking Pools in 2025

1. Sanctum Infinity

Quick Overview

In surveying the landscape of Solana liquid staking opportunities, Sanctum Infinity (INF) stood out for its balance of performance, security, and innovation. Infinity solves one of Solana's biggest inefficiencies: fragmented liquidity. Below, we break down how we scored it, why it leads the pack, how it compares to others, where it can improve, and why we recommend it as our top choice.

Sanctum Score: 94/100

| Category | Score (/100) | Summary |

|---|---|---|

| Security and Audits | 95 | Infinity has been audited by three separate auditors, and follows leading Solana security best practices. |

| Yield Optimization | 99 | Yield comes from both underlying staking rewards and trading fees captured within the Infinity pool, producing some of the highest sustainable yields on Solana. Current yields are the highest out of any liquid staking option with 9.17% APY in the last 10 epochs. |

| Liquidity Depth | 93 | Rather than fragmenting liquidity across individual LSTs, Infinity aggregates it. This design creates deeper markets and reduces slippage under stress. |

| Validator Strategy | 80 | Validator exposure is indirect; Infinity relies on delegation from its constituent LSTs rather than managing validators directly. This keeps complexity low but limits transparency. |

| Innovation | 95 | Introduces Solana’s first multi-LST routing system, unifying liquidity across assets and setting a new standard for LST interoperability. |

Weighted across categories, Sanctum Infinity achieved an overall score of roughly 94 out of 100. This puts it ahead of all major Solana LSTs in our model as the best choice for gaining yield on your SOL.

Pros:

Meta-layer architecture: Rather than building yet another single-token staking pool, Infinity creates a layer that connects all LSTs through fair-value routing. Every swap is priced at the on-chain intrinsic SOL value of each LST. This means trades occur with zero price impact.

Multiple yield streams: In addition to base staking rewards, Infinity distributes fees collected from LST-to-LST liquidity pool swaps. This compounds value for holders and makes INF's yield higher and more sustainable. The yield grows with ecosystem activity rather than relying on short-term incentives.

Superior exit flexibility: Users can redeem INF for any underlying LST or for SOL directly. If routing can't satisfy the trade, the protocol's Reserve pool acts as a liquidity backstop. It's a design built for real-world reliability, not just efficiency under ideal conditions.

Unified liquidity: On Solana, dozens of stake pools compete for liquidity, splitting user capital and diluting efficiency. Infinity's approach aligns incentives by creating shared depth and composability across the ecosystem.

Best-in-class yield efficiency: Infinity's liquidity pool allows instant, zero-slippage swaps across multiple assets. This offers smoother exits and higher effective yield than competitors like JitoSOL. It captures trading fees that other protocols miss.

Mature ecosystem: Infinity has proven market depth and yield mechanisms with 40,000 holders and over $300 million in TVL.

Cons

Indirect validator exposure: Infinity relies on the delegation strategies of its constituent LSTs rather than managing validators directly. This makes it harder for users to assess decentralization compared to protocols with direct validator control.

Key Stats

- Swap fee: 0.08% (8 basis points)

- APY: 9.12% (as of 10/28/25)

- Withdrawal fee: 0.10% (INF → SOL or LST)

- Reserve capacity: Historically, about 700,000 SOL (600,000 SOL in reserve, 100,000 SOL in Infinity itself) available for liquidity

- Yield composition: Weighted LST staking rewards plus internal trading fees

- Supported deposit assets: SOL and all major Solana LSTs, including mSOL, bSOL, JitoSOL, and others

- Audits: Multiple third-party audits, including OtterSec and Neodyme

- Design: Built on Solana Labs' SPL stake pool program (audited nine times, secures billions of dollars)

Why Sanctum Ranked First

Sanctum was one of the original pioneers of liquid staking, helping Solana Labs create the SPL stake pool program. Now, they are pushing the boundaries forward with the new Sanctum Infinity token. It provides liquidity to other Solana LSTs, enhances yield through natural market activity, and provides instant, flexible exits, all while maintaining the security of Solana's core stake pool framework. It turns LSTs from isolated assets into a cohesive, composable layer of DeFi infrastructure.

For users who want the highest yield without giving up liquidity, institutions seeking scalable exposure to Solana staking, and DeFi builders who need stable LST liquidity to build on, Infinity is the liquid staking optionthat best balances innovation with reliability.

It is rare to find a project that pushes the boundaries of yield and efficiency without compromising on safety. Sanctum Infinity does exactly that. That's why it earned the top score in our evaluation and our strongest recommendation overall.

2. JupSOL

Among Solana’s leading liquid staking platforms, Jupiter’s JupSOL stands out as the premier user-facing product built on top of Sanctum’s liquid staking infrastructure. It combines institutional-grade security and yield mechanics with the simplicity and reach of Jupiter’s ecosystem, allowing users to stake SOL in a single click and access deep on-chain liquidity without navigating multiple platforms.

JupSOL excels in making high-performance staking effortless and broadly accessible. JupSOL was created in partnership with Sanctum and has many of the pros of INF while still being a true LST.

JupSOL’s strength lies in translating complex yield routing and validator logic into a seamless, reliable product that any Solana user can trust. Below, we outline how JupSOL earned its near-top score, where it excels, where it can improve, and why it has become a popular on-ramp for liquid staking on Solana.

JupSOL Score

JupSOL scored 91 out of 100 overall.

| Category | Score | Description |

|---|---|---|

| Security and Audits | 95 | Built directly on Sanctum’s audited SPL stake pool infrastructure and governed by a multisig shared among Jupiter, Sanctum, and community partners, providing both decentralization and accountability. |

| Yield Optimization | 90 | Combines staking rewards, validator tips, and MEV income routed through Sanctum, generating consistently strong APYs with minimal volatility. |

| Liquidity Depth | 92 | Deep two-sided liquidity sourced from Jupiter’s DEX network and Sanctum’s unified reserves ensures stable pricing and efficient swaps at scale. |

| Validator Strategy | 78 | Delegation currently centers on Jupiter’s primary validator, backed by a multisig oversight process. While secure, validator diversification remains limited. |

| Innovation | 90 | Pioneers the “branded LST” model—allowing applications to launch tokens on Sanctum’s infrastructure—blending DeFi routing with productized staking. |

Pros

- Seamless UX: One-click staking directly within Jupiter’s interface—no external platform or wallet steps.

- Deep Liquidity: Integrated across Jupiter’s routing layer and Sanctum’s unified reserves for stable exits and minimal slippage.

- Strong Yield: Delivers high, consistent returns derived from staking rewards, MEV, and validator priority fees.

- Composability: Works natively with the broader Solana DeFi stack and integrates automatically into Jupiter swaps and liquidity routes.

Cons

- Validator Centralization: Primarily delegated to Jupiter’s own validator

- Limited Customization: Users cannot yet select validators or customize delegation strategy.

Key Stats

- APY: 6.78% (as of 10/28/25)

- Performance Fee: 0% (Sanctum routing model; no protocol commission taken)

- Validators: Primarily Jupiter’s primary validator, expanding to a multi-validator structure via Sanctum

- Governance: Joint oversight between Jupiter core contributors and Sanctum multisig

- Audits: Built on the SPL stake pool program, audited by Neodyme, OtterSec, and Kudelski Security

3. JitoSOL Overview

JitoSOL, developed by the Jito Network, is one of Solana’s more widely adopted liquid staking tokens. It pioneered the integration of MEV (Maximal Extractable Value) capture into staking yields, allowing users to earn both validator rewards and MEV proceeds from Solana’s block production. Known for its security, decentralization, and DAO governance, JitoSOL is a leading LST.

Jito Score:

JitoSOL scored 88 out of 100 overall.

| Category | Score | Summary |

|---|---|---|

| Security & Audits | 95 | Built on the audited SPL stake pool contract, fully transparent, DAO-governed, and time-tested. |

| Yield Optimization | 82 | Incorporates MEV and priority fees for steady, above-average returns. |

| Liquidity Depth | 90 | Deep markets on Orca, Meteora, and Jupiter enable efficient swaps with minimal slippage. |

| Validator Strategy | 83 | Jito StakeNet actively balances across 200+ validators to reduce centralization risk. |

| Innovation | 82 | Was first Solana protocol to integrate MEV yield-sharing into staking rewards. |

Pros

- MEV and priority fee capture deliver consistent, transparent yield gains.

- Highly decentralized validator network improves network resilience.

- Strong DAO governance and long-term operational record.

- Deep, stable liquidity across multiple DEXs.

Cons

- Yield is steady but lower than multi-asset or fee-sharing protocols.

- Limited user customization in validator selection.

- Exit liquidity depends on external DEX markets.

Key Stats

- APY: 6.16 (as of 10/28/25)

- Performance fee: 4%

- Validators: 200+

- Governance: Jito DAO

- Audits: SPL stake pool + independent security reviews

4. Marinade Finance

Marinade Finance (mSOL) introduced the concept of tokenized stake liquidity on Solana in 2021, but has fallen behind both Santum and Jito in recent years. Marinade converts SOL into mSOL, a liquid staking token that appreciates in value as rewards accrue.

Marinade operates as a non-custodial DAO-managed protocol built on Solana’s SPL stake pool framework. It automatically distributes stake across over a hundred independent validators using a transparent algorithm that prioritizes performance and decentralization. Its goal is simple: maximize validator diversity while providing users with an easy and secure way to earn staking rewards without locking up their SOL.

Marinade Score

Marinade scored 78 out of 100 overall.

| Category | Score | Description |

|---|---|---|

| Security and Audits | 95 | Built on the audited SPL stake pool contract, fully transparent, DAO-governed, and time-tested. |

| Yield Optimization | 55 | Provides reliable but modest staking yields. Limited integration of MEV and priority fees results in below-average performance. |

| Liquidity Depth | 83 | Maintains deep mSOL/SOL liquidity across major DEXs and lending platforms, though not unified through router architecture. |

| Validator Strategy | 88 | Delegates across 100+ validators using an algorithmic rebalancer to maintain decentralization and network resilience. |

| Innovation | 65 | Early innovator in LSTs, but recent progress has slowed. Newer options have surpassed it in composability and yield design. |

Pros

- Strong security track record and audited codebase

- Highly decentralized validator set

- Deep and consistent DEX liquidity

- Transparent DAO governance

Cons

- Yields limited to base staking rewards

- Instant unstake capacity is finite

- Lacks additional yield or routing layers found in newer protocols

Key Stats

- Estimated APY: 6.71% (as of 10/28/25)

- Validators: 100+

- Governance: Marinade DAO

- Audits: Multiple independent reviews

- Launch: 2021

- Token: mSOL

5. Phantom

Overview:

Phantom PSOL (Phantom Staked SOL) is the liquid staking product developed by the Phantom wallet team, designed to make staking on Solana effortless for everyday users. Integrated directly into the Phantom wallet, PSOL allows users to stake SOL with a single click and receive PSOL, a liquid staking token that automatically appreciates as rewards accrue. Unlike traditional staking, PSOL can be used throughout Solana’s DeFi ecosystem while still earning validator and network rewards. By combining Phantom’s massive user base, native wallet integration, and seamless user experience, PSOL bridges the gap between casual users and advanced DeFi participants.

Phantom’s approach focuses on simplicity and accessibility rather than experimental yield mechanisms. Built on Solana’s audited SPL stake pool program, PSOL maintains strong security guarantees. It captures both validator rewards and priority fees from transactions to deliver a modest but consistent yield. Liquidity and exits are handled directly within the wallet via integrated swaps, offering users instant conversion between PSOL and SOL where available, or delayed unstaking when necessary.

Phantom PSOL Score

Phantom PSOL scored 70 out of 100 overall.

| Category | Score | Description |

|---|---|---|

| Security and Audits | 95 | Built on the audited SPL stake pool contract, fully transparent, DAO-governed, and time-tested. |

| Yield Optimization | 45 | Offers baseline staking yield without MEV or restaking integration. Designed for convenience, not performance. |

| Liquidity Depth | 65 | Liquidity confined largely to Phantom’s internal swap routes, resulting in thin markets under stress. |

| Validator Strategy | 75 | Operates with a small validator set managed by Phantom. Transparency and rotation details are limited. |

| Innovation | 55 | Focused on wallet UX rather than protocol innovation. No new mechanics beyond simplified staking access. |

Pros

Seamless staking experience directly inside the Phantom wallet. Reliable and secure foundation using audited SPL contracts. Earns additional yield from MEV and transaction fees. Growing liquidity and ecosystem adoption due to Phantom’s user reach.

Cons

Limited validator transparency and customization. Smaller liquidity reserves compared to larger protocols. Yields are moderate relative to more complex multi-asset LST systems.

Key Stats

- APY: ~6.38% (as of 10/28/25)

- Performance Fee: 0% (standard validator commission only)

- Validators: Small, curated validator set operated by Phantom; limited public detail

- Governance: Managed internally by Phantom Labs with no on-chain DAO structure

- Audits: Built on Solana’s SPL stake pool program; no separate public audit disclosures

| Protocol | Security | Yield | Liquidity | Validator Strategy | Innovation | Total Score |

|---|---|---|---|---|---|---|

| 🥇 Sanctum Infinity | 95 | 99 | 93 | 80 | 95 | 94 |

| 🥈 JupSOL (Jupiter × Sanctum) | 95 | 90 | 92 | 78 | 90 | 91 |

| 🥉 JitoSOL | 95 | 82 | 90 | 83 | 82 | 88 |

| 4️⃣ Marinade (mSOL) | 95 | 55 | 83 | 88 | 65 | 78 |

| 5️⃣ Phantom (PSOL) | 95 | 45 | 65 | 75 | 55 | 70 |

Why Sanctum Infinity is the best token for Liquid Staking

Solana's liquid staking sector faced a structural problem: liquidity fragmentation. Each new LST created isolated liquidity pools, requiring independent integration work and capital bootstrapping. This created barriers for protocols wanting to launch staking products and reduced capital efficiency across the ecosystem.

Sanctum's Infinity pool addresses this through architectural innovation. Rather than implementing another AMM variant, the protocol uses stake account-based pricing to support swaps between any two LSTs without constant-product curves or external oracles. This enables even low-TVL LSTs to access instant liquidity by sharing Infinity's aggregated depth. When Binance launched bnSOL or Jupiter deployed JupSOL, liquidity bootstrapping became unnecessary. Sanctum's infrastructure handled day-one liquidity.

The macro opportunity remains significant. At 13.6% penetration of total staked SOL, Solana's liquid staking sector has substantial room for growth compared to Ethereum's maturity. As adoption increases, unified liquidity infrastructure becomes increasingly valuable. Protocols building on Sanctum access existing liquidity pools that compound with each new LST deployment rather than fragmenting capital.

FAQs

What is liquid staking on Solana?

Liquid staking converts your staked SOL into a tradeable token (LST) that represents your staking position while continuing to earn validator rewards. Sanctum enables this through its Infinity pool, which aggregates multiple LSTs into a unified liquidity layer, allowing you to deposit SOL and receive LSTs that can be traded, used as collateral, or deployed in DeFi applications without unstaking delays. This eliminates the tradeoff between earning staking rewards and maintaining liquidity while providing instant access to deep cross-LST liquidity and better yield.

How do I choose the right liquid staking pool?

When evaluating liquid staking pools, prioritize security (smart contract audits and validator quality), liquidity depth (exit options during market stress), and yield composition (base staking vs. MEV vs. DeFi opportunities). Sanctum stands out by solving the liquidity fragmentation problem enabling instant swaps between any LSTs through the Infinity pool. It also powers custom LST launches without massive capital requirements. Choose Sanctum when you need cross-LST flexibility, want to launch custom staking products, or seek diversified LST yield exposure through the INF basket token.

Is Sanctum better than Jito for liquid staking?

Jito is a solid LST and is ranked 3rd in our list, but Sanctum offers higher yields and better liquidity. Sanctum is the clear winner here.

If I'm successful with traditional SOL staking, should I move to liquid staking?

If you’re earning well from traditional SOL staking, consider liquid staking for added flexibility and potentially higher yield. Traditional staking locks your SOL, while Sanctum’s liquid staking lets you keep earning validator rewards and use your tokens in DeFi. Through Sanctum INF, you can swap between LSTs or hold a diversified basket that compounds both staking and liquidity rewards. To balance performance and risk, start by converting only part of your staked SOL.

What's the difference between mSOL, JitoSOL, and INF?

mSOL and JitoSOL are both LSTs. INF provides diversified exposure by holding a basket of multiple high-performing LSTs. Unlike single-LST solutions, Sanctum's INF automatically rebalances across the liquid staking ecosystem. It earns both staking yields and trading fees from the Infinity pool. INF outperforms alternatives by offering higher yield, portfolio diversification, automatic optimization across LSTs, and exposure to the unified liquidity layer rather than single-validator concentration.

What are the best alternatives to Marinade Finance?

Sanctum offers the most comprehensive alternative to Marinade. It enables both individual LST access and unified cross-LST liquidity through the Infinity pool. Plus it provides infrastructure for launching custom LSTs without Marinade's capital requirements. Sanctum powers LST launches for major protocols like Jupiter, Binance, and Bybit. Choose Sanctum when you need flexibility beyond a single LST, want to launch your own staking product, or prefer the INF basket approach over Marinade's mSOL.de