Don’t be fooled by the buttery smooth liquid staking token (LST) experience that is commonplace for end users across Solana DeFi activities.

Setting up and running an LST is much harder than it looks.

That’s why at Sanctum, as a part of our Staking as a Service product offering, we enable our partners to launch custom LSTs. We’ve guided the world’s largest crypto companies like MoonPay (mpSOL) and Jupiter (JupSOL) through the hidden complexities of Solana liquid staking and the process of launching their own branded LST.

Here’s how we do it.

What Sanctum Brings To The Table

We’ve been building in Solana’s staking sector since 2021, starting our journey by contributing to Solana Labs’ original SPL stake pool program.

Today, we power one of the most battle-tested LST infrastructure on Solana as the chain’s fourth-largest protocol by TVL, securing over $2.5B in stake across our ecosystem. And as we’ve grown, Sanctum LST partners have earned over $5 million in additional revenue through their LSTs.

Safe to say, we know this space inside out. Not in theory, but in practice.

So trust us when we say: If your team is interested in launching an LST, there’s the hard way, and there’s the Sanctum way.

“We didn’t need to worry about bootstrapping liquidity for our LST, making it much cheaper to run and generate revenues to give back to holders.” - Soju, JupSOL LST project lead

Most teams underestimate the cost, complexity, and time it takes to get an LST operating in proper fashion. And while launching an LST is hard, operating one at scale is even harder.

Liquidity is the most difficult component.

To launch an LST on your own, securing deep, stable SOL liquidity is an unavoidable prerequisite. Doing so means either deploying your own capital or negotiating with market makers—both of which come with additional cost and overhead. Without it, your LST won’t trade efficiently, and your largest holders will be burdened with high slippage.

Then, there’s the operational burden.

Cranks need to be run every epoch to keep your pool state accurate. If they aren’t, rewards go stale and state breaks. You also need to stay ahead of upstream changes in the Solana runtime and stake program. These evolve frequently: partitioned epoch rewards, validator leader schedule shifts, stake distribution logic, and slashing mechanics. Each change needs to be monitored, tested, and integrated safely into your LST.

All of this will require real engineering work. Some of it is simple. Some of it isn’t. Either way, working on your own, these problems are yours to solve.

Sanctum abstracts all of that pain away. No additional dev work. No liquidity to manage. Just a new source of revenue with the best yield for your customers—one that has earned our LST partners over $5 million in additional revenue.

The Ultimate Turnkey LST Solution

Launching an LST isn’t like flipping on a light switch, it’s activating an entire product stack. To succeed, you need deep liquidity, flawless operations, day-one DeFi integrations, and a compliant operating model. Sanctum provides all of this out of the box, letting your team focus on brand and distribution.

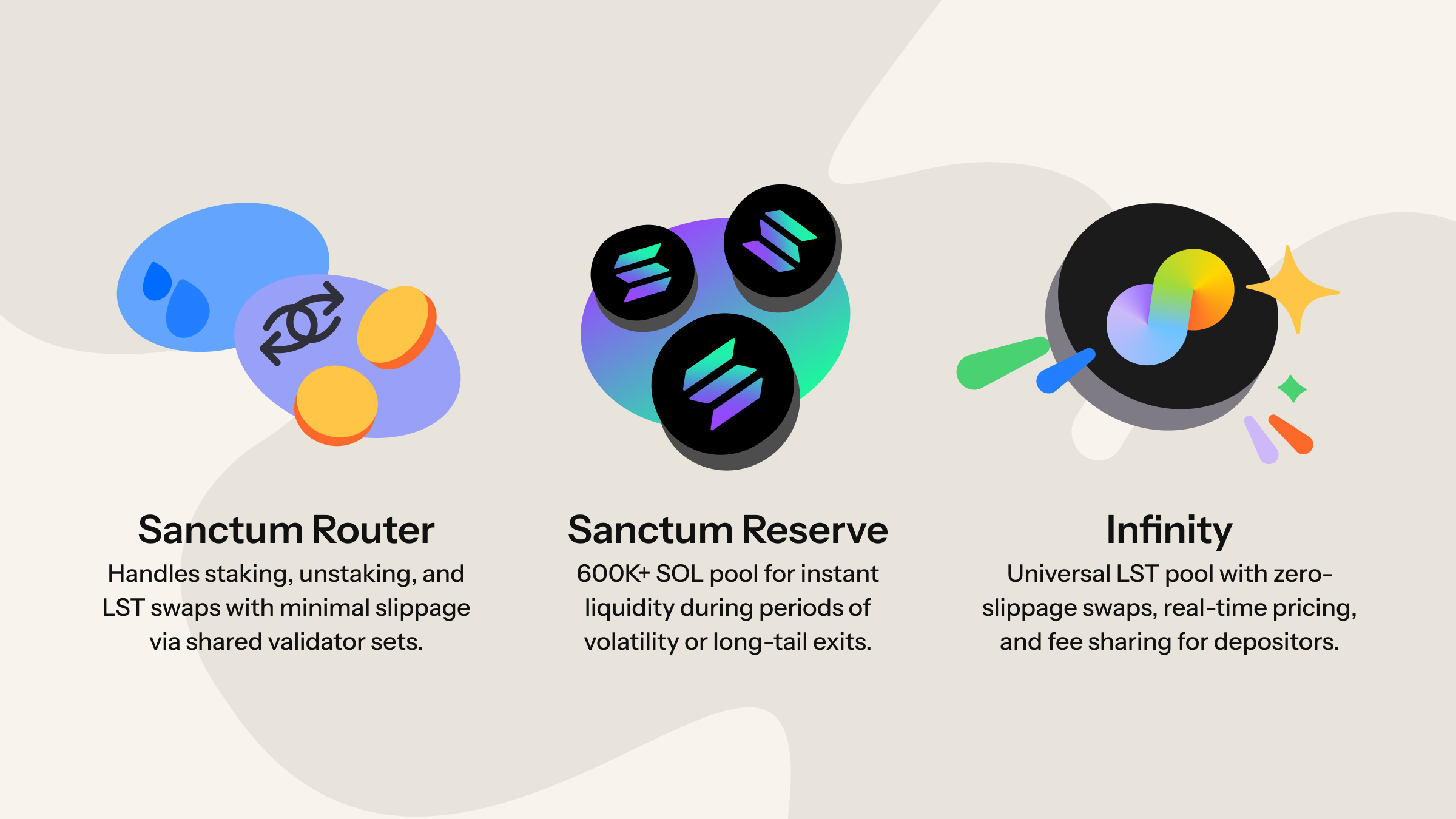

Sanctum’s Liquidity Stack

Building deep, efficient SOL liquidity is hard, and failure is what breaks most LSTs. Without it, swaps fail, redemptions stall, and users get punished with slippage. Success in this area requires capital, custom infrastructure, and constant upkeep.

Some teams try to solve liquidity by bribing LPs. For example, one of the largest LSTs on Solana spends over $30,000 per week via token incentives to maintain liquidity.

We’ve taken a different approach. Our liquidity infrastructure, fine-tuned over years, unifies all LSTs into a single pool and rewards LPs with real yield from staking and fees. This approach is more sustainable, supported by the network effects of more LSTs launches. Through this pool, we’ve handled over 9.6 million SOL in swap volume and operate with over 400,000 SOL in active reserve liquidity.

This infrastructure protects your biggest LST holders against price impact so that you never have to worry about disappointing them.

Best in Class Operations, Security, and Yield

A great LST should feel boring.

Our 24/7 on-call engineering team takes care of the tedious operational and security concerns so that your holders enjoy the most competitive LST yields on Solana with minimal slippage. We run epoch cranks on schedule, manage pool state, and track changes to the Solana runtime and stake program—whatever is necessary to keep you unsurprised.

In terms of security, Sanctum helped write the original SPL stake-pool program with Solana Labs, which currently secures more than $10 billion in AUM. Over the years, we have found, reported, and resolved multiple critical exploits in the stake-pool program.

Maximizing yield is not trivial. If you delegate your LST stake to the Sanctum Validator, we can maximize your LST’s yield with zero fees. To do so, we run dual servers in separate regions with custom hardware, instant failovers with zero downtime upgrades, and multiple Solana clients.

Launch With Day One DeFi Integrations

Sanctum lines up DeFi venues on day one so holders can borrow, loop, and earn, without your team needing to run point on the BD. We manage the process end to end, coordinating listings, creating the right vaults, aligning risk parameters and caps, and supporting incentives when they move the needle. For added assurance, we partner with Allez Labs, experts in DeFi data and risk management since 2019.

Integrations that our team sets up for your LST include:

Jupiter

Your LST is listed on Jupiter upon setup, which unlocks fast distribution and clean swaps across the ecosystem.

Leading Wallets

Your LST is recognized in the biggest Solana Wallets for a seamless holder experience.

Kamino Multiply

The classic leveraged staking loop - multiply LST exposure for multiples on yield.

Additional Venues

We line up listings on lending and leverage markets in the ecosystem as they launch.

Built For Compliance In Your Jurisdiction

If your jurisdiction restricts launching an LST, use our Operator Model Service Agreement!

We deploy and administer the stake-pool program and token wrapper, manage upgrades, take emergency actions, and operate the product day to day. In short, this means your company is not the token issuer.

The agreement defines roles clearly: Sanctum is the technical operator of record, responsible for contract deployment, parameter changes, incident response, and ongoing maintenance. You keep control over brand and distribution and receive revenue share under the contract.

We provide documented change control, audit trails, and runbooks enabling any reviewer to see exactly who does what, when, and how.

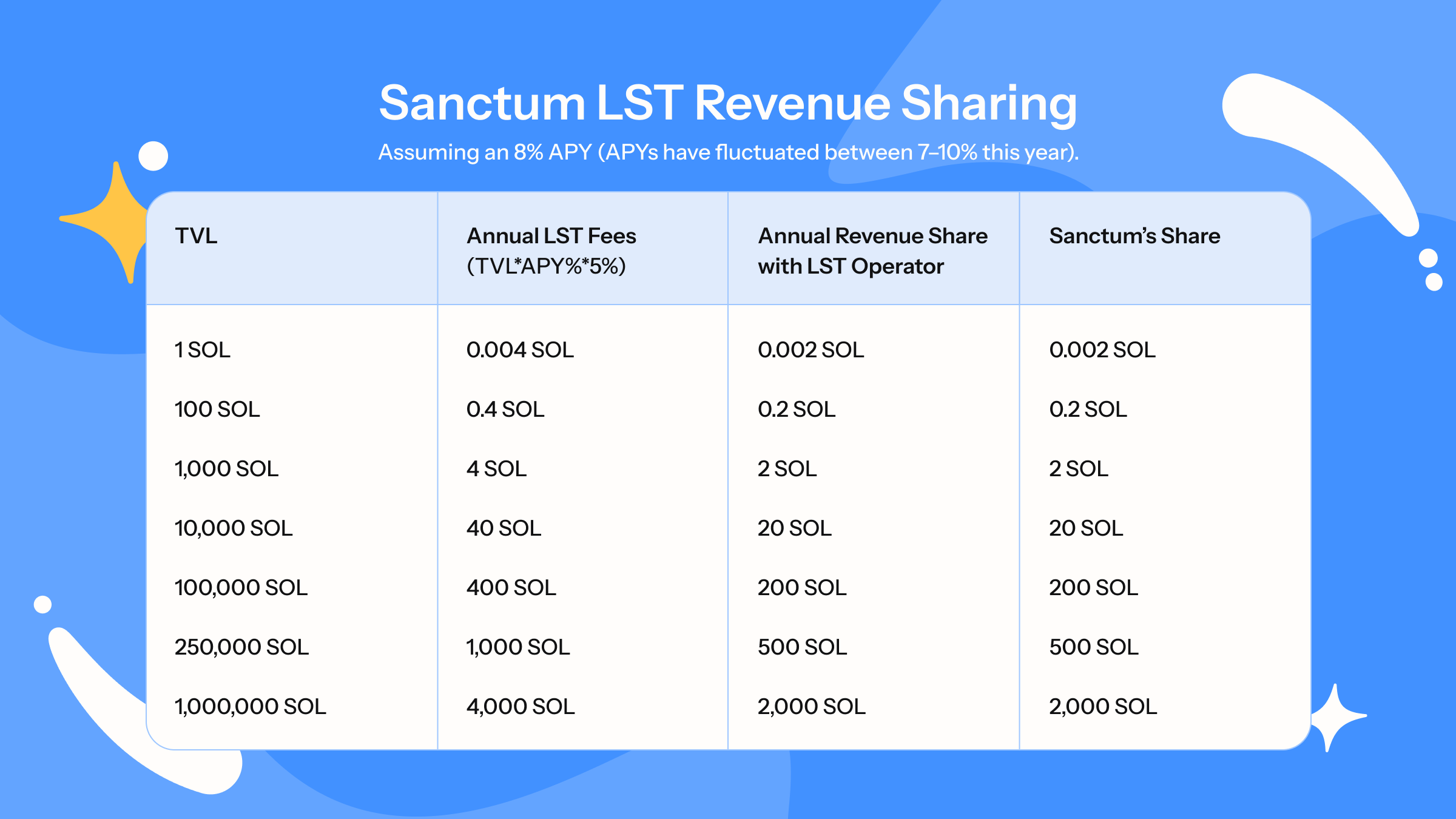

Revenue Sharing

Each epoch, 5% of staking yield is split. Half of this (2.5%) goes to Sanctum to maintain operations, liquidity infrastructure, and ongoing support. The other half (2.5%) goes directly to you as revenue share, creating a new and predictable income stream.

This revenue-sharing model is designed for clarity and fairness. In practical terms, consider that at an 8% staking yield, holders see 7.6% a difference of only 0.4%. In fact, the operational improvements we provide, such as optimized validator performance or reduced downtime, often exceed the yield impact, making the effective cost to holders virtually zero.

Other LSTs often charge hidden deposit fees, which forces your customers to take a loss before they see any yield. Our model aligns our incentives with yours; we only win by helping your LST attract and retain stake for the long term, not by shuffling users between different LSTs.

Sanctum Select Delegation Program

When teams prioritize their LST and integrate it meaningfully into their products, the results compound. By contrast, LSTs treated as an afterthought rarely see real adoption, no matter how much stake is allocated to them. Our Select Delegation Program is our way of aligning incentives with teams that are serious about long-term growth, view it as a collaborative effort, as we do.

For partners that make their LST a first-class citizen in their product lineup, Sanctum provides extra support. As part of this initiative, we can allocate a portion of Infinity liquidity directly to partners that demonstrate strong validator performance and meaningful ecosystem adoption.

To qualify, partners must:

- Achieve a consistently competitive APY on their LST

- Maintain at least 10,000 SOL in external stake

How To Start Launching Your LST

Launching an LST with Sanctum starts with providing a few key branding details:

- High-resolution logo

- Full token name

- Ticker symbol

- Metadata (optional)

It’s that simple.

Once we receive your branding information, deployment is quick. Our team usually completes the process within a couple of days, though it may take up to a week depending on internal bandwidth.

During onboarding, your team may also provide a wallet address for your 2.5% revenue share and generate a custom vanity address, such as:

Jupiter - jupSoLaHXQiZZTSfEWMTRRgpnyFm8f6sZdosWBjx93v

Helius - he1iusmfkpAdwvxLNGV8Y1iSbj4rUy6yMhEA3fotn9A

Bybit - Bybit2vBJGhPF52GBdNaQfUJ6ZpThSgHBobjWZpLPb4B

Immediately after launch, your LST will be available for trading and have a dedicated page on the Sanctum explore page. Full integration with Jupiter will follow shortly after, usually within two to three Solana epochs, as Jupiter completes its verification and indexing.