Staking SOL is essential for keeping the Solana blockchain running. Without it, Proof of Stake validation simply wouldn’t work.

For contributing to the network by staking SOL, you’ll earn roughly 6-7.5% APY. The problem? Your capital is locked up with validators and can take up to 5 days to access. You can’t trade it, use it as collateral, or deploy it in DeFi. It just sits there.

Liquid staking fixes this. You convert your staked SOL into tradeable tokens that keep earning validator rewards while you use them however you want.

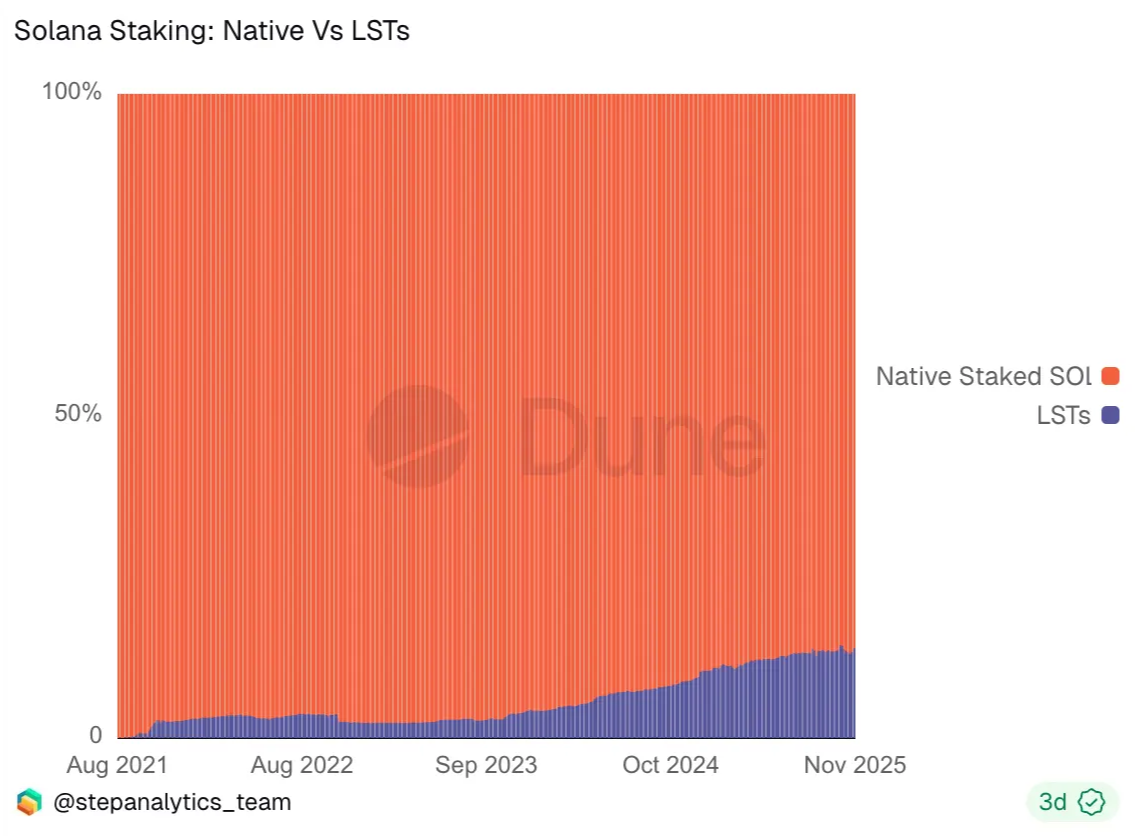

Currently, 60.5 million SOL is allocated to liquid staking tokens, representing 13.76% of all staked SOL, and this number is consistently increasing with time.

How Solana Staking Works: Proof of Stake Rewards Explained

Solana runs on Proof of Stake. In this model, users stake SOL to validators that process transactions and produce blocks. They earn rewards using your staked SOL and pass a portion of those rewards back to you. Over 1,000 validators currently secure the Solana network, with base yields sitting between 6-7.5% APY.

Every 2-3 days (a period called an epoch), rewards get distributed based on how much you staked and how well your selected validator performed. Validators, in turn, make money by taking a commission on the reward they gain.

The catch with native staking? When you want to unstake and regain liquidity, you typically have to wait 2-3 days before getting your SOL back. Liquid staking solves this problem by giving you access to your capital instantly!

What Liquid Staking Solves: How LSTs Work

Liquid staking turns your staked SOL into something you can actually use.

When you deposit SOL into a stake pool, you get back a Liquid Staking Token (LST). These liquid staking tokens represent your claim on the underlying staked SOL, plus all the rewards that build up over time. They’re essentially a receipt of your deposit that can be freely transferred.

One of the first things you’ll notice about LSTs is that their prices do not stay pegged 1:1 with SOL. With native staking, any SOL you stake is returned to you as SOL because it is directly used to validate blocks.

Liquid staking works differently. Instead of paying rewards directly in SOL, LSTs function as a reward-bearing token, meaning that each LST represents a claim on the underlying staked SOL plus the rewards it generates (it’s an asset bearing rewards). As those rewards accumulate, each LST becomes redeemable for more SOL over time.

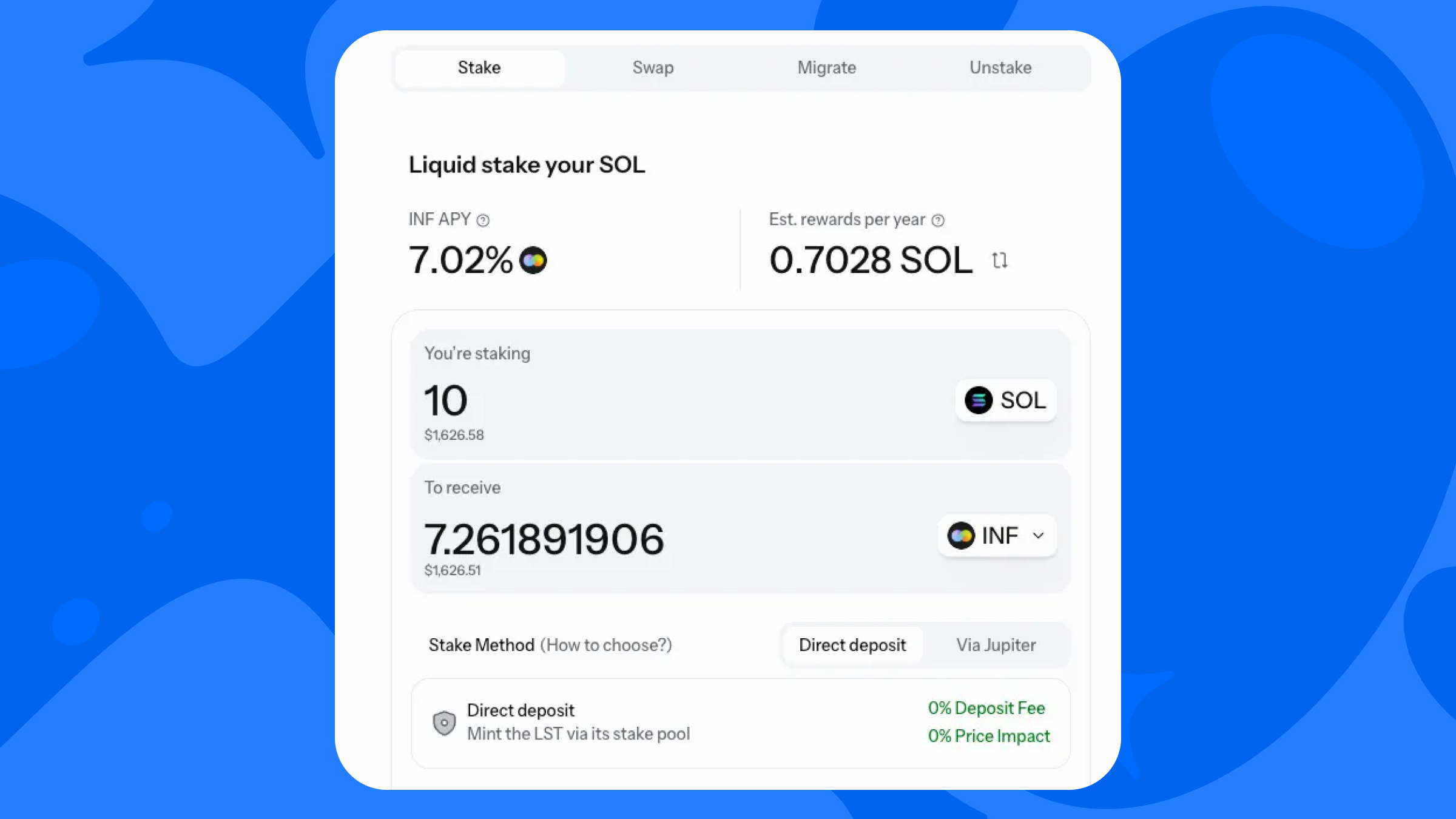

For example, if you stake 100 SOL to Infinity and receive 72.6 INF, it is because 1 INF is currently worth about 1.38 SOL. As rewards accumulate, that ratio continues to increase. When you eventually redeem your 72.6 INF, you might receive 103 SOL. The extra 3 SOL is simply the staking yield that accumulated while you held the LST.

The key benefit is that while your SOL is staked through an LST like INF, the token itself stays liquid. You can trade it on DEXs, use it as collateral, provide liquidity, and more. There is no need to wait 2 to 3 days to access your capital.

Liquid staking options can also capture additional revenue beyond basic staking rewards, enabling them to pay you more, which results in LSTs oftentimes having higher SOL yields than native staking. This makes them a best of both worlds option; you get liquidity for your tokens and more yield than native staking — win-win!

As of November 2025, 13.76% of all staked Solana is staked via LSTs. There's currently a total of 60.5 million SOL in LSTs representing ~$10B in dollar value. Ethereum currently has LST staked percentage at 29.9%, so there's plenty of demonstrated room for liquid staking on Solana to grow.

What are the leading liquid staking tokens?

When you're looking to stake your Solana, there are a couple of great options.

Infinity (INF)

Sanctum's flagship token that takes a completely different approach to liquid staking on Solana.

- 3.3% market share with 7.1% APY (highest yields in the market)

- Operates as an LST-of-LSTs that holds a basket of high-performing LSTs instead of staking to validators, meaning you’re always earning the highest LST yields

- Earns from both staking yields AND trading fees from facilitating LST swaps in the Infinity unified liquidity pool

- Outperformed JitoSOL by 28% and mSOL by 20% (over approx. 50 epochs) in Q3, 2025

JupSOL

Jupiter's liquid staking token, powered by Sanctum, designed to work seamlessly with their DEX ecosystem.

- 8% market share with 6.61% APY

- Stakes to Jupiter's validator for better transaction priority during congestion

- Best if you're already deep in the expansive Jupiter ecosystem

JitoSOL

The largest LST on Solana by market share.

- 22.8% market share with 5.71% APY

- It has been around since late 2022

- Lower yields but high liquidity across DeFi protocols

How to Stake your SOL with an LST

Staking your SOL to an LST is really easy with Sanctum! We support most LSTs on the market and allow for staking, swapping, migrating, and unstaking. In this guide, we’ll walk through how to stake your Solana to an LST and use INF as a practical example.

Staking to INF:

Head to our staking product, connect your Solana wallet, and enter how much SOL you want to stake. You'll see the transaction details, fees, current APY, and how much INF you'll get based on the current exchange rate.

You can choose to stake either via direct deposit or our integration with Jupiter.

Once you stake, your INF shows up in your wallet immediately and starts earning right away as the underlying LST basket generates staking rewards and the pool collects trading fees. There’s no lockup period, no picking validators, no unstaking cooldown.

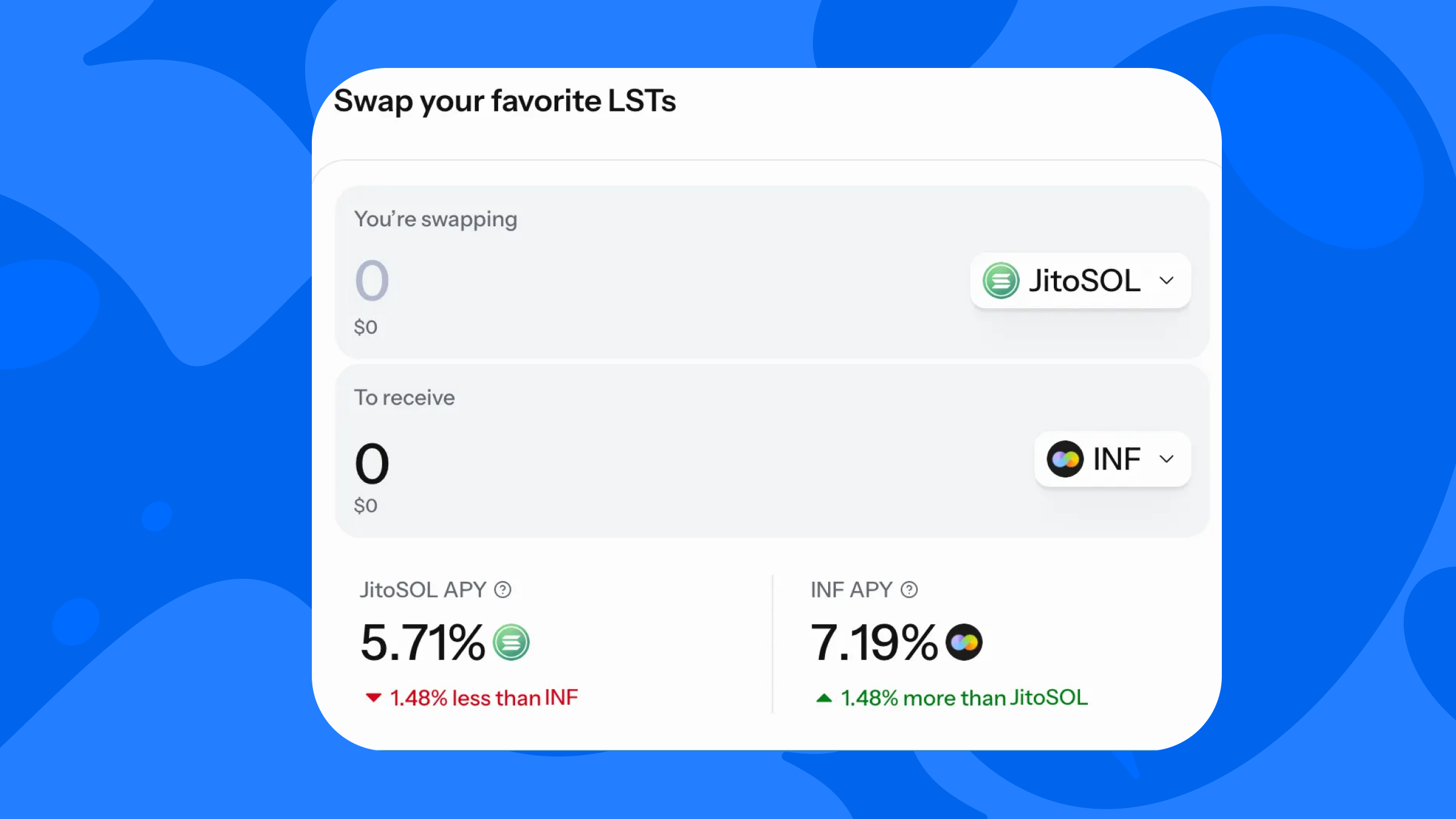

Swapping between LSTs:

On Sanctum, you can also swap between LSTs. Infinity provides liquidity to LSTs and allows us to facilitate swaps with lower fees than others. To swap, visit our swap product. Pick your source token and what you want to swap to. The interface shows you the exchange rate and comparative APYs.

In the example below, we can see that INF has nearly 1.5% better APYs than Jito, currently. This could be a good time to swap JitoSOL to INF to take advantage of this higher yield.

Transactions settle instantly at the specified price. Moving from a lower-yielding LST to INF means you immediately start capturing that higher APY plus the trading fee distributions!

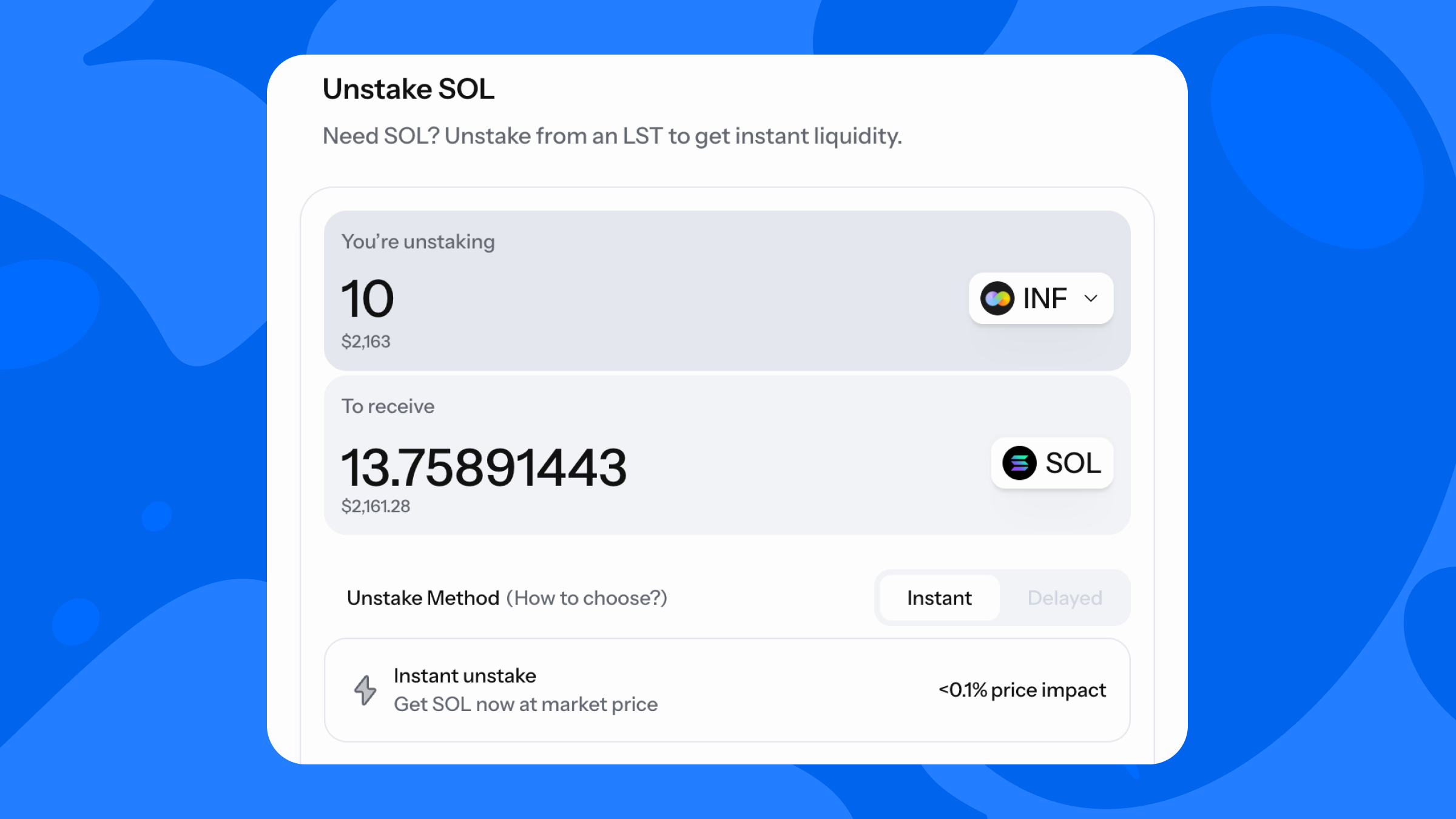

Unstaking an LST:

When you want to get your liquid SOL back after staking, you can leverage Sanctum’s unstaking product. Here you can unstake any LST and receive SOL tokens with instant unstaking and minimal price impacts.

Risks with Liquid Staking Tokens

Smart contract risk: You're trusting code. If there's a bug, your funds can be exposed.

Infinity builds on Sanctum’s deep experience contributing to the building of Solana's original SPL stake pool program, which now has nine independent audits and billions of dollars secured across many ecosystem LSTs. Infinity itself has a slightly different code that has had three audits (OtterSec, Sec3, and Neodyme) and has been running for over a year without issues.

Depeg risk: LSTs can temporarily trade below their real value during market panic.

For example in December 2023, mSOL briefly depegged under heavy selling. It traded below what it was actually worth until things calmed down.

Infinity handles this better through its multi-asset design. Redemptions can route through any asset in the pool instead of depending on one LST's liquidity. This significantly lowers depeg risk compared to other tokens.

How to stay safe: Check reserve levels before big trades. Expect some slippage during crazy markets.

Validator risk: Your yields depend on validator performance. If they go offline or miss blocks, your returns drop.

INF spreads this risk by holding a basket of LSTs. Each LST is involved with its own validators. You're not tied to one validator's performance when you choose to liquid stake with INF.

How to stay safe: Check validator strategies. Look for pools with many validators. Diversify if you're holding a lot.

What’s next for Liquid Staking Tokens?

Institutional money is starting to pile into Solana staking. Multiple asset managers filed for spot SOL ETFs in 2025. Bloomberg puts approval odds at 95%. JPMorgan estimates these ETFs could pull in $3-6 billion in the first six months alone.

Corporate treasuries are getting in on it, too. Companies like DeFi Development Corp are using custom LSTs launched with Sanctum to generate yield on their SOL holdings while keeping things liquid for shareholders. This is a new adoption path that didn't exist with traditional staking.

Solana is only at 13.76% liquid staking penetration while Ethereum is at 29.9%. If Solana follows a similar curve, we're looking at potential 2-3x growth in the amount of tokens that are staked via liquid staking.

As the ecosystem grows, unified liquidity infrastructure becomes more valuable, not less. Every new LST that launches on Sanctum's infrastructure strengthens the network effect. Every swap through Infinity generates fees for INF holders. The system gets more efficient with scale instead of fragmenting.

For SOL holders, it comes down to what you're optimizing for. If you want simple set-and-forget staking, native staking or traditional LSTs work fine. But if you want higher yields, added reassurance of instant liquidity, and stability and yield outperformance when market chaos takes place (INF notched a 26.12% epoch return during the October 10 crash), multi-LST strategies like Infinity offer real structural advantages. That 3% yield difference between INF and traditional LSTs compounds to meaningful outperformance over time.

Frequently Asked Questions

What are the best Solana staking rewards available?

The best Solana staking rewards come from protocols that stack multiple revenue streams. Traditional staking Solana rewards sit at 6-7.5% APY. Multi-LST strategies like INF hit 9.17%+ APY by combining staking yields with trading fees from liquidity provision.

What is liquid staking and how do liquid staking protocols work?

Liquid staking lets you stake your SOL and still use it. You deposit SOL into a stake pool, get LST tokens back, and keep earning staking rewards while those tokens stay tradeable. The protocols handle all the validator stuff, distribute your rewards, and keep liquidity available so you can exit instantly when you want.

How do SOL staking rewards compare to native staking?

SOL staking rewards through LSTs beat native staking by 1-3% APY. Native staking gives you 6-7.5% from basic validator rewards. LST protocols add MEV capture, priority fees, and trading fees on top. The tradeoff is smart contract risk (though, at this point, proven to be minimal thanks to Solana’s battle-tested SPL stake pool contract) versus that 2-3 day wait when you unstake natively.

What are liquid staking tokens (LST crypto)?

Liquid staking tokens (or LST crypto) are tokens that represent your staked SOL. Popular ones include JitoSOL, mSOL, JupSOL, and INF. These tokens increase in value as staking rewards accumulate. You can trade them, use them as collateral in DeFi, or provide liquidity, all while earning staking yields.

Should I stake Solana?

If you're holding SOL and want to earn 6-9% APY instead of letting it sit idle, yes. Staking helps secure the network and generates passive income for you. With liquid staking, you don't even have to lock up your capital, so it's virtually a no-brainer for most SOL holders.

Where to stake SOL for the best returns?

For the highest yield with instant liquidity: Sanctum Infinity at 7.1% APY. For simplicity with solid returns: JupSOL 6.61% APY or JitoSOL 5.71% APY. For baseline yields with simple convenience: native staking through your wallet.

Ready to start earning higher yields on your SOL? Visit app.sanctum.so/infinity to stake your SOL to INF.