You own some SOL and want to stake it—but where do you start? You’re not alone. Nearly 50,000 wallets have chosen to stake with Infinity, and there are good reasons why.

The Rise of Liquid Staking

Liquid staking on Solana has come a long way. What started with 1.5 million SOL staked across fewer than five LSTs has grown to over 40 million SOL across more than 1,000 LSTs (source: Dune).

Driving this transformation is Infinity, one of Sanctum’s flagship products. Infinity gives stakers access to optimised liquid staking yields through an actively-managed basket of LSTs.

Infinity Is Optimised for Liquid Staking Yields on Your SOL

Infinity is a liquid staking strategy built on top of LSTs on Solana, designed to deliver attractive yields by holding a basket of high-performing LSTs. Some users find it helpful to think of Infinity as a smart, yield-optimised LST index.

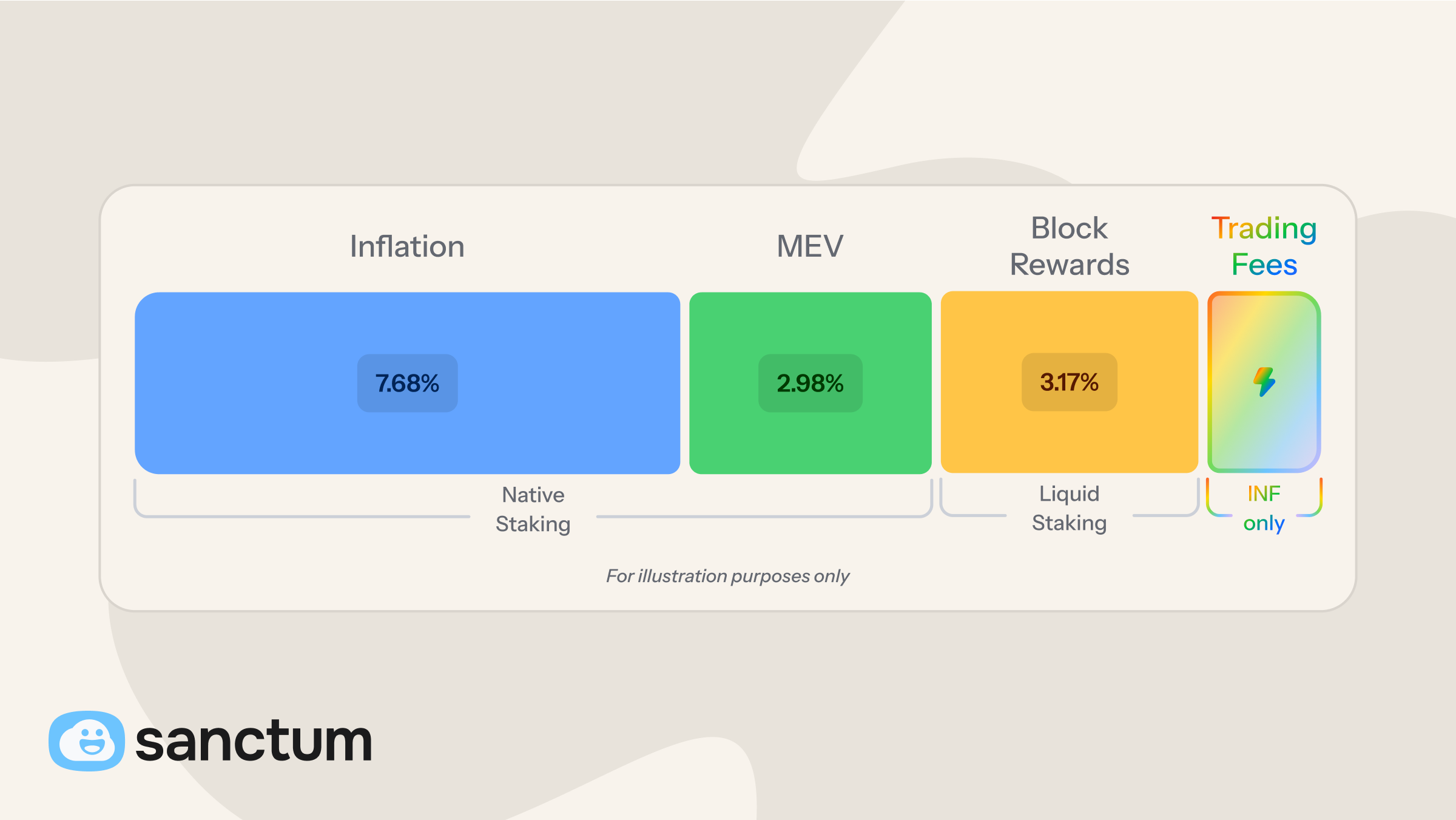

Infinity's strong performance comes from its two key features:

- It holds an ever-changing basket of high-performing LSTs.

- It captures and shares trading fees with you.

This means that when you stake with Infinity, you earn a weighted average of the staking yields from the LSTs it holds—plus extra yield from the trading fees it captures.

Infinity Facilitates Trades and Captures Fees

So, how does Infinity earn trading fees in the first place?

This is where it's helpful to think of Infinity as a multi-asset liquidity pool. It facilitates trades between any two LSTs it holds and collects a fee on every trade routed through it—just like most liquidity pools would.

What makes Infinity different from other liquidity pools is that trades routed through it have zero price impact.

How does Infinity achieve that? All LSTs have their own exchange rates that can be read directly from the on-chain states of their associated stake pools. Infinity leverages that design and removes the need for constant-product or stableswap formulas, allowing trades of any size to happen at fair value.

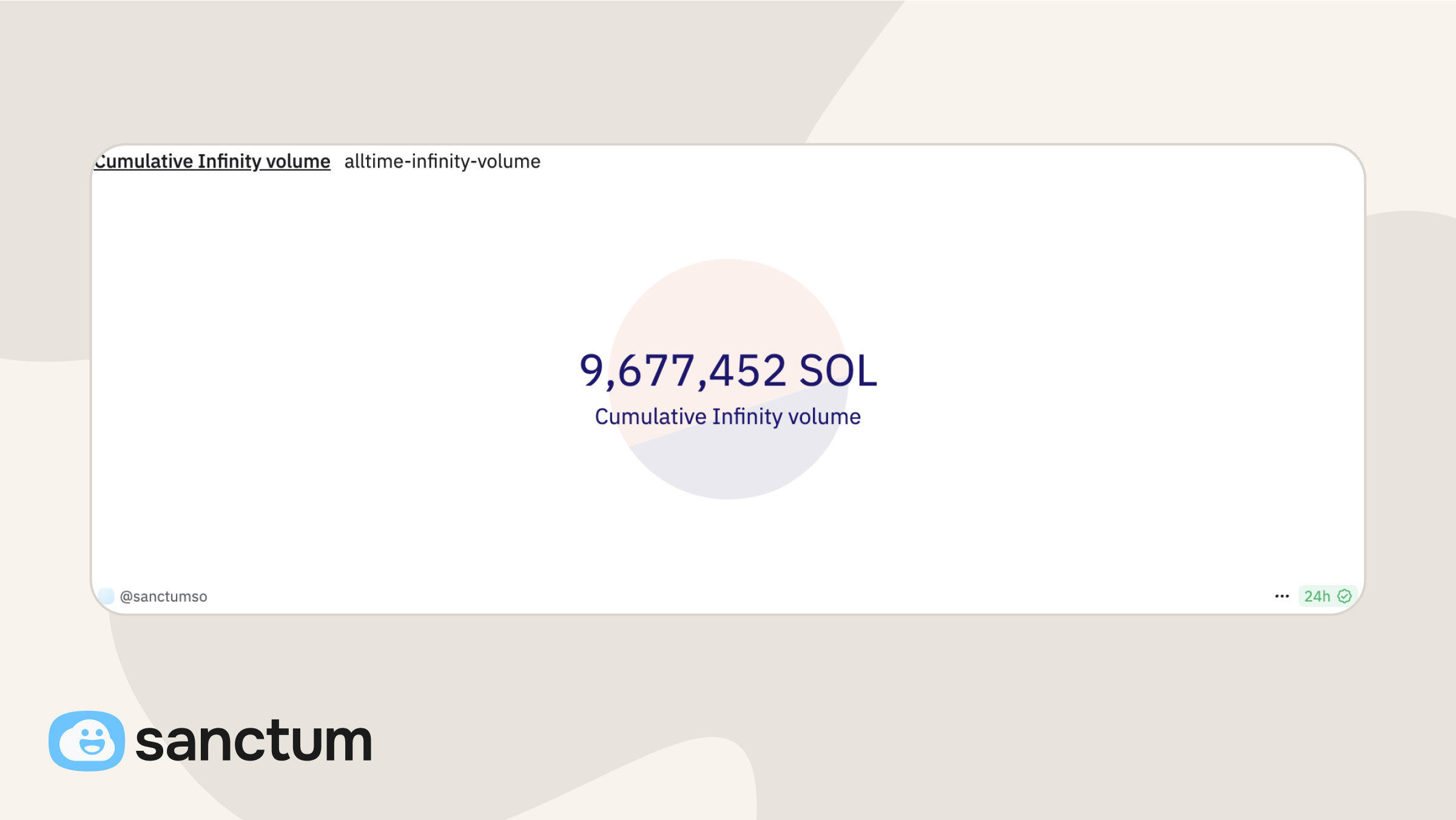

This makes Infinity an ideal route for most LST trades. In fact, if you’ve traded LSTs on a Solana DEX like Jupiter, there’s a good chance your trade went through Infinity—because it often offers the best price.

Since launch, Infinity has facilitated over 9.6 million SOL (~$1.4 billion at today's prices) worth of trades and shared close to 8,000 SOL (~$1 million at today's prices) in fees with its stakers.

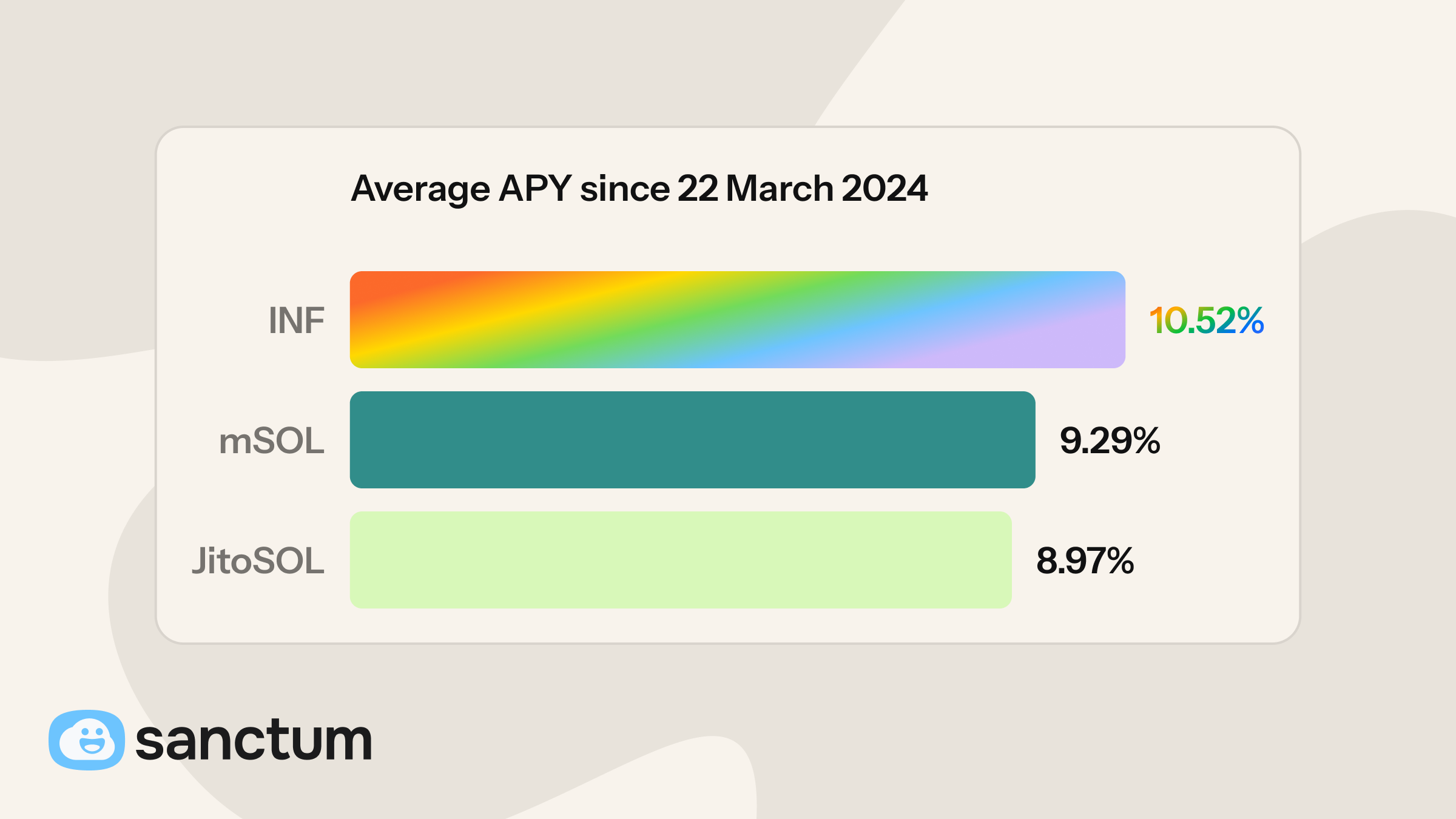

Infinity's Consistent Outperformance

Due to these two key features, Infinity has consistently outperformed many well-known LSTs and validators. You can check out their historic performances in our comparison tool here.

What is the INF token?

INF is the token that represents your share of the total SOL value of all the LSTs currently held by Infinity's multi-LST liquidity pool. You can get INF by depositing SOL or LSTs directly into Infinity, or by swapping for INF using any Solana tokens (see below).

Either way, holding INF means you own a slice of Infinity's growing pool—and automatically earn yield as the pool's SOL value increases.

How Can I Stake With Infinity?

Staking with Infinity is simple. If you’re holding INF in your wallet, you’re already staked and earning yield.

There are a few easy ways to get INF:

- Deposit SOL or LSTs directly into Infinity at app.sanctum.so/stake.

- Swap SOL or any LST to INF at the same link

- Swap any Solana token to INF using your favourite DEX or wallet.

No lockups. No extra steps. Just hold INF in your wallet and you’re staked. You're free to unstake and swap out of INF anytime.

Why is 1 INF not equal to 1 SOL?

INF is a reward-bearing token, not a rebasing token. This means its yield isn’t delivered by minting more INF, but by each INF becoming more valuable relative to SOL. So when you unstake, you’ll receive more SOL than you originally put in.

You can learn more about reward-bearing tokens in our docs here.

Is Staking With Infinity Safe?

Like any protocol on Solana, Infinity carries smart contract risk. That said, it's built with security at its core.

Infinity is built on top of the official Solana Stake Pool program, the most audited program on Solana and the one securing the largest amount of total value. In addition, Infinity itself has been audited by three independent firms and has safely secured upwards of 2 million SOL during Sanctum’s Wonderland campaign back in 2024.

While composing on top of the Stake Pool program adds some complexity, Infinity has proven reliable with over a year of secure performance on mainnet. Its risk profile is similar to providing liquidity on a DEX—both are built on heavily audited, battle-tested code that underpins Solana DeFi.

Infinity's code is open-sourced for you to do your own research; you can find its codebase here.